Judges divide property in a Florida divorce based on an equitable distribution model. Their determination of what is fair and equitable does not necessarily mean splitting things 50-50. Understanding how judges divide stocks and investments in a divorce can be confusing but critical for protecting your interests.

The experienced Orlando divorce attorneys at O’Mara Law Group help couples reach fair resolutions when dividing stocks and investments. We will devise a plan that reflects both parties’ needs and construct agreements that adhere to Florida law so a judge can sign off on them as equitable. If a contested divorce is unavoidable, we will use our in-depth knowledge of Florida divorce law to protect your interests.

Key Takeaways

- Florida employs an equitable division of property model in divorces rather than splitting assets and liabilities 50-50.

- Marital property stocks are subject to equitable division, and couples must decide whether to sell or keep them for later distribution.

- Divisions of investments such as timeshares and rental properties depend partly on whether they generate income.

- Early withdrawals from an IRA or 401(k) can effectuate tax penalties, but tax-free options exist for dividing those accounts.

- Couples can maintain or surrender life insurance policies, but if they surrender, the amount gained over what they paid is taxable income.

How Are Stocks Divided in a Divorce in Florida?

Stocks purchased during marriage are likely marital property subject to division. Those purchased before marriage or gained through inheritance usually belong only to the holding spouse. One party can keep marital stocks and surrender other assets for equitable distribution. They also can liquidate the portfolio, but that may carry tax implications.

If you profit from selling a stock you’ve owned for less than a year, you are subject to short-term capital gains tax. Holding it longer than a year allows you to count the proceeds as long-term capital gains taxed at a lower rate.

If one or both spouses hold stock options, the timing of your divorce is important. These investments are not transferable, so you cannot split them. You must agree on whether and when to exercise those options and how to divide the resulting shares. The holding spouse could also agree to relinquish other marital assets and keep options.

There are additional considerations aside from your stock portfolio if you are part of a military divorce, including the division of a military pension. Our accomplished divorce attorneys can assist you with devising an equitable division. We also can help if things become complicated later and you need divorce modifications.

Division of Investments in a Divorce

An equitable division of investments partly depends on whether they are merely assets or provide an income stream. With the help of our experienced Florida divorce law firm, you can achieve an equitable distribution that accounts for various value factors. If you do so before your divorce, you don’t have to rely on a judge’s property division that could leave both parties unhappy.

Timeshares in a Divorce

There are generally three options when dividing a timeshare in a Florida divorce. You can sell it, though this is not always easy, and you must consider who pays maintenance fees until the sale. You also can divide the timeshare. Using it on alternate dates and splitting maintenance fees may be ideal for couples who can’t decide what to do.

Another option is to negotiate whether one spouse keeps the timeshare. The person who holds the property can buy out their spouse or surrender other marital assets so that the overall property division is equitable.

Rental Properties in a Divorce

The division of rental properties can be complicated because they have a base value and provide an income stream. One party receiving the marital home and another receiving an equally valued rental property is likely not equitable. Over ten years, a rental property that generates $2,000 a month in income provides an additional $240,000 in value minus expenses.

As part of an equitable division, one spouse may move into the rental property, removing it as an income stream. A couple also could sell the property and split the proceeds. Alternatively, they may keep the property and agree to split the rental proceeds and maintenance costs, but it can be tricky for divorced couples to work together.

You must consider upkeep costs and future fluctuations in a rental property’s value. A potential complication is a tenant with a valid lease who does not want to vacate or is paying below-market-value rent.

Inheritances in a Divorce

Inherited assets are generally not subject to property division, but there are exceptions. If the inheritance is commingled with other marital property, a judge may determine it is subject to division. For example, if a spouse inherited a rental property and used marital funds to pay the mortgage, it likely becomes marital property.

A judge may also decide that an inheritance is marital property because it was used to the benefit of the other spouse during the marriage. For example, an inherited second home may be a joint vacation property or generate income to pay the mortgage on the family home. This use to a spouse’s benefit may turn the asset into marital property.

Retirement Accounts Division in a Divorce

Failing to divide retirement accounts properly can elicit penalties and taxes. How you or a judge chooses to divide them depends on the type of accounts you hold and what fits each spouse’s needs.

401(k) Accounts

If a spouse contributes to a 401(k) during marriage, it may become marital property subject to equitable division. Contributions made before the marriage or after a separation likely belong to the contributing spouse.

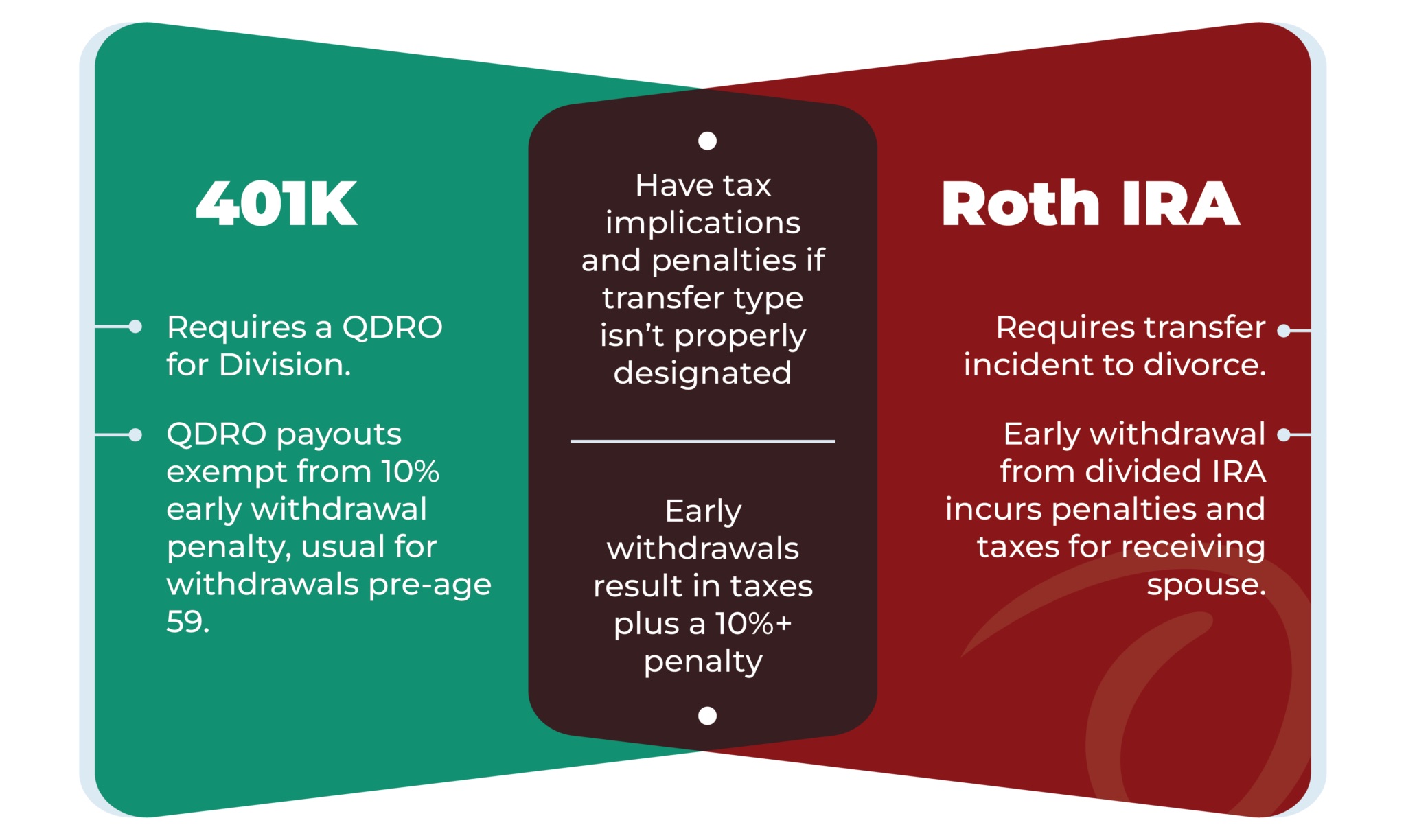

If a spouse is entitled to a portion of a 401(k), you must submit a Qualified Domestic Relations Order, or QRDO, to the judge. This document outlines the division of the account. If the judge accepts the QRDO, it goes to the plan administrator. Failure to utilize a QRDO could yield penalties and additional taxes.

The named spouse may keep the 401(k) account by surrendering other assets in the divorce. They also can liquidate a 401(k) and split the proceeds equitably, which may carry penalties and tax consequences for early withdrawal.

A more attractive option may be to divide a 401(k) by rolling over a portion into an IRA for the other spouse. This rollover is tax-free. If a receiving spouse needs money, you can split the 401(k), and the amount the receiving spouse gets through a valid QRDO is not subject to early withdrawal penalties.

Traditional and Roth IRAs

When splitting an IRA, you must specify that you are making a transfer incident to divorce. Once the transfer is finalized, the receiving spouse is responsible for any tax or other penalties related to account distributions. If you do not label your IRA division as a transfer, the entire amount the receiving spouse receives is subject to tax penalties and early withdrawal charges.

There are no tax penalties for rolling a portion of an IRA into another IRA for the receiving spouse.

Similarities and Differences in Splitting Retirement Accounts

It is essential to understand the implications of splitting different types of accounts.

Understanding the tax and financial implications of splitting your retirement funds is particularly important if you are nearing retirement age. Younger couples have time to grow their retirement plans after divorcing, while older couples may suddenly be left with half the retirement income they expected. Mistakes in dividing these accounts make a bad situation worse.

Splitting retirement accounts is a remarkably complex aspect of divorce. For detailed information and advice, consult an experienced divorce attorney from O’Mara Law Group.

Life Insurance in a Divorce

Couples can choose to maintain a life insurance policy following divorce, or a judge may order a spouse to keep one to protect alimony and child support payments. Once the divorce is final, the policyholder must contact their insurance company and reaffirm their ex-spouse as the beneficiary. Under Florida law, ex-spouses lose their right to collect life insurance without that affirmation.

Life insurance division becomes complicated if the couple chooses to surrender the policy and take the cash value. If the cash value exceeds what you paid into it, you must decide who will pay taxes on the difference. That money is considered income.

The division is also more complex if an outstanding loan is against the life insurance policy’s cash value. You must determine how to pay off that loan to maintain coverage. If you choose to surrender the policy, the loan amount counts against its cash value.

Why Choose the O'Mara Law Group To Help with Your Divorce Property Division

Florida is an equitable distribution state that does not require 50-50 marital property division in divorces. Thus, determining a fair division is often complicated and nuanced. Every divorce is unique, and you need an experienced attorney to protect your interests in dividing stocks and investments.

We focus on helping people find equitable solutions during difficult situations. We firmly believe that every party in a divorce deserves respect and decency and can reach fair outcomes without resorting to name-calling and other unnecessary tactics. Our award-winning attorneys have earned recognition from several respected local and national sources, including:

- Orlando Family Magazine Awesome Attorneys in Family Law

- American Institute of Family Law Attorneys

- Super Lawyers

- A 10.0 Avvo Superb Rating, the highest available

- A Martindale-Hubbell AV Preeminent Rating, the highest available

Our attorneys have a long history of client satisfaction because we understand the law and know how to protect your interests while supporting you through an emotionally difficult time. Contact us today at (407) 634-6604 or use our online form to schedule a consultation.